It's time to bring Scottish Oil home & invest in Scotland’s future

If you are Looking for North Sea Oil Facts & Figures they are at the bottom of this page, please scroll down slowly.

Offshore incomes belong to Scotland

Ministers in Edinburgh are preparing to legislate to ensure much of the fortune earned by the Crown Estate from the multi-billion-pound offshore energy industry goes to local communities in Scotland.

The move by the Scottish Government comes after The Herald highlighted the possibility of the Crown Estate rights to the seabed being challenged by Holyrood, at a critical time when licences for renewable energy have massive financial potential.

Read this full article in the Herald

Sign our e-petiton to revoke the 1999 order that made 6,000 sq miles of Scottish sea and sea bed English. Alternatively support our facebook cause.

60% INCREASE IN ESTIMATES OF UNTAPPED OIL AND GAS IN SCOTLAND

Scotland has much more oil and gas than previously thought, but the London government continues to neglect Scotland.

The London government's tax regime punishes Scotland's oil industry.

Meanwhile, PetroChina Co., China's biggest energy producer, hopes to take over Scotland's only oil-processing plant, which is at Grangemouth.

http://scot-land.blogspot.com

Secret plan to deprive independent Scotland of North Sea oil fields

by moving Scotland's marine boundaries from Berwick-up-on-Tweed to Carnoustie.

The shocking thing about this secret order is that it was not openly discussed in the Commons, passed by the house of Lords and then passed by a very select Labour and Liberal committee in the Scottish Office.

One wonders if, Her Majesty Queen Elizabeth the First of Scotland, knew how undemocratic this order was before she signed it ??

Sign our e-petiton to revoke the 1999 order that made 6,000 sq miles of Scottish sea and sea bed English. Alternatively support our facebook cause.

This unjust act secretly passed, without the consent of the Scottish People took 15% of oil and gas revenues out of the Scottish sector of the North Sea taking £2.2 Billion out of the Scottish economy. This lost revenue is more than the proposed £35 Billion Scottish budget cuts for the next 15 years (£2.16 Billion per year)

Documents detailing secret government plans in the 1970s to prevent Scotland laying claim to North Sea oil have been seen by The Times. They show the extraordinary lengths to which civil servants were prepared to go to head off devolution, which was seen then as inevitably leading to independence. read more of this article in The Times

Scotland gives LONDON all of its oil and gas revenues, in 2008 these were worth a massive.

£380 a second, £22,831 a minute, £32.8 million a day, £1 billion a month, £12+ billion a year

Scottish Crude Oil 18 Month High as of 6th April 2010 Brent Crude peaks at $86.63 a barrel

Experts calculate how much the Scottish Sea bed is worth more

Scotland's Oil Wealth that Westminster have hidden from the Scot's.

Since the North Sea Oil was discovered the powers in Whitehall have done everything in their power to deceive the Scottish people of the chronic surplus's of their economy. As proven by the 1974 ![]() report written by Gavin Mc Crone on Scotland's economy. This report was classified top secret due to its contents.

report written by Gavin Mc Crone on Scotland's economy. This report was classified top secret due to its contents.

There has always been a debate / deceit about Scotland's fiscal position without oil.

The most recent Government Expenditure and Revenue Scotland (GERS) figures demonstrate that

Scottish public finances ran current budget surpluses in each of the three years to 2007-

08, totaling £2.3 Billion. In comparison the UK ran a budget deficit in each of those years totaling-£24 Billion.

| Balance on current budget - £ billions | 2005-06 |

2006-07 |

2007-08 |

Totals |

|---|---|---|---|---|

| Scotland | 1 |

1.1 |

0.2 |

2.3 |

| UK | -13.9 |

-5 |

-5.1 |

-24 |

A report by accountancy firm Grant Thornton shows that if an Independent Scotland received only 82.5% of North Sea Oil and Gas revenues (without out the 6,000 sq miles of Scottish waters, London made English in 1999) Scotland would have a budget surplus of £4.4 billion, with 95% of revenues (with Scotland's marine boundaries restored) this would increase to £6.2 billion. It is abundantly clear that Westminster’s financial black hole is being filled with Scotland’s black, black oil.

![]() Please support and promote Scottish Independence join the SNP from a £1 a month.

Please support and promote Scottish Independence join the SNP from a £1 a month.

Please help get the truth of Scotland's rich economy that is in surplus, opposed to the UK economy which is in deficit, out to those who are fooled by the barrage of lies from the London parties - click here

Norway's sovereign wealth fund: £259bn and growing

When North Sea Oil was discovered in the waters of Scotland and Norway in the late 1960's. Norway an Independent Nation smaller than Scotland with worst maritime weather than Scotland reaped the benefit of being in sole control of their oil revenues. Today 30 years after the oil started coming ashore Norway has created £259 Billion sovereign wealth fund. If Scotland had become Independent shortly after the rigged devolution referendum of 1979 Scotland would have accumulated a simi liar fund that would have easily covered the UK's £175bn budget deficit. Read the full story on Norway's success story

Should Norway openly support Scottish Independence by pledging to spend some of it £259 billion sovereign wealth fund in Scotland.

Then promote North Sea oil, gas, wind, wave energy and manufacturing partnership deals among Norway and Scotland.

This alliance would be a major benefit to the Nations who control the North Sea.

Unfortunately London has controlled Scotland's oil revenues and sold off Scotland oil far to cheap, wasted it on the fall out from not joining the euro, fighting wars and has now used any surplus left on bailing out the banks that it failed to regulate. Unlike London, Norway are using their oil revenues to embrace Green Energy.

The London Government have committed themselves to building eleven new nuclear power plants which will cost substantially more than sustainable Green Energy.

Read the Scottish Governments white paper on Scottish Independence

Online Norwegian Translation ?

Skal Norge å åpne støtter Skotsk Uavhengighet ved den LOVE til å bruke noe av £259 milliard suverenere rikdoms fonds i Scotland.

Da fremm Nordsjøen olje, gass, vind, bølgeenergi og produseringsepartnerskaphandel blant Norge og Skottland.

Les de Skotske Myndighetene hvit papir på Skotsk Uavhengighet.

Denne alliansen ville være en hovedfordel til Nasjene som styrer Nordsjøenen.

Dessverre har London styrt Skottlands oljeinntekter og solgte av Skottland olje fjernt til billig, sløste det på fallet ut fra ikke forbinde euro, som bekjemper kriger og nå har brukt noe overskudd som blir forlatt på trekke seg bankene som det unnlot til å regulere. Ulik London, Norge bruker deres oljer inntekter til å omfavne Grønn Energi.

London Myndigheten har seg forpliktet til bygger elleve nye atomkraftanlegg som vil koste vesentlig mer enn substainable Grønn Energi.

An oil find in the North Sea off Aberdeen has the potential to be one of the biggest discoveries of recent years.

EnCore Oil said the Catcher prospect is thought to hold up to 300 million barrels of oil, and further investigations could add to this.

It would make Catcher among the largest discoveries since the billion barrel Buzzard reservoir off Aberdeen in 2001.

Read the updated story in the Herald

http://www.bbc.co.uk/news/10434538

A new oil and gas field in West Shetland is to be drilled for 176 million barrels.

Faroe Petroleum expects to get two cracks at drilling the UK Atlantic Frontier this summer.

Faroe Petroleum expects to get two cracks at drilling the UK Atlantic Frontier this summer.

The first is as a partner in OMV’s Tornado oil & gas prospect, the drilling of which should start in July. The second is Glenlivet, which operator DONG will spud in the autumn and where the target is gas.

The so-called P10 recoverable resource estimate stands at 176million barrels oil equivalent. That means the chance of finding that volume of hydrocarbons is just 10%, whereas the P50 (mean) figure is in the range 90-100million barrels.

However, there is scope for additional upside potential in the nearby Spitfire lead – perhaps about 27million barrels equivalent.

Successfully drill this field, would probably pave the way to reviving the nearby, but moribund, Suilven oil discovery of the 1990s. Read the full story. BBC News Report

Massive oil fields discovered on Rockall - Rockall is a rocky islet in the North Atlantic Ocean lies within 200 nautical miles from the Scottish Islands of North Uist and St Kilda.

Massive oil fields discovered on Rockall - Rockall is a rocky islet in the North Atlantic Ocean lies within 200 nautical miles from the Scottish Islands of North Uist and St Kilda.

As Scotland is the closest Nation with an existing Oil Industry, this could be another Scottish Oil Bonanza.

Rockall is a small, uninhabited, rocky islet in the north Atlantic Ocean. It gives its name to one of the sea areas named in the Shipping Forecast, provided by the British Meteorological Office. It could be, in James Fisher's words, "the most isolated small rock in the oceans of the world".

The ownership of Rockall is disputed as are the exploration and fishing rights on the Rockall Bank. Exchanges continue between the countries involved - the United Kingdom, Denmark (for the Faroe Islands), Ireland and Iceland. Rockall is now actually now part of the Scottish Western Isles.

Wikipedia The BBC The Guardian

Aberdeen firms report oil and gas in sidetrack well on west of Shetland prospect

Hopes are rising that the Tornado oil and gas discovery west of Shetland is large enough to be brought into production.

Aberdeen companies Dana Petroleum and Faroe Petroleum said yesterday that oil and gas had been found in a sidetrack well at the prospect.

Last month, the two firms said oil and gas had been located at Tornado. The discovery and sidetrack wells were drilled by operator OMV, the Austrian national oil and gas company.

Pre-drill estimates were for Tornado to have 90million-100million barrels of oil equivalent recoverable. Dana said last month that the thickness and quality of the Tornado reservoir was in line with pre-drill expectations.

The company added yesterday: “The gas-oil contact which was penetrated in the original well was encountered in the sidetrack at the same depth.

“An oil-water contact was penetrated in the sidetrack consistent with the oil column observed in the original well. Extensive sampling of the fluids has been undertaken.”

Dana chief executive Tom Cross said: “We are delighted to have discovered oil and gas in both the original Tornado well and the sidetrack well.

“A thorough analysis of data gathered is already underway.”

North Sea Oil and Gas is an asset worth £234,000 for every man, woman and child in Scotland, according to the official London Government figures ?

The North Sea has almost as much oil left as has already been extracted, a BBC Scotland investigation has been told. Click for the Full Story on Scotland's remaining oil wealth that is worth £234,000 to you, each of your children and everyone you know that lives in Scotland.

North Sea Oil will last another 100 years

Oil industry analysts predict that North Sea Oil Production will continue for 100 years at least. Watch the video on Scotland's endless oil supplies

Read the Telegraph

Dr Richard Pike, a former oil industry consultant and now the chief

executive of the Royal Society of Chemistry, said: "Rather than only getting 20 to 30 billion barrels [from the North Sea] we are probably looking at more than twice that amount."

Read the Daily Mail

"The North Sea is not running out at all, industry, analysts say.The full extent of reserves in the sea has never been known"

Oil is the UK's Largest Industry landing 700,000 barrels of oil per day more figures

We know from the UK government’s own figures that there could be as much as 38.7 billion barrels of oil

left (calculation 38,700,000,000 barrels x £20.67 tax per barrel = £800 Billion in today's money this could reach £1.2 Trillion in 30 years time.) With just 35 billion barrels recovered to date we are still at the half way point for this

important Scottish industry. What is more, given the premium placed on energy resources, there may

be two-thirds of the revenues still remaining in the North Sea, with an additional £800 billion pounds

to come from Scottish waters in today's money. The history of the price of oil

The choice for Scotland is clear – those revenues either flows south to London or they can be invested

in Scotland for the people of Scotland.

![]() Scottish Oil is worth £22,831 a minute, £32 million a day, £12 billion a year

Scottish Oil is worth £22,831 a minute, £32 million a day, £12 billion a year

![]() Scotland could build 2 High Schools or 16 wind turbines a day with it's VAST oil revenue, if it did not give it to LONDON. In 66 days Scotland's oil money could pay for the rebuilding all Scotland's High Schools or in 16 days the World's largest wind farm! Another day it could fund building 256 two bedroom houses to solve Scotland's chronic housing problems or it could also give each Premier Division Club each £2.66 Million

Scotland could build 2 High Schools or 16 wind turbines a day with it's VAST oil revenue, if it did not give it to LONDON. In 66 days Scotland's oil money could pay for the rebuilding all Scotland's High Schools or in 16 days the World's largest wind farm! Another day it could fund building 256 two bedroom houses to solve Scotland's chronic housing problems or it could also give each Premier Division Club each £2.66 Million

Any modern economic policy requires a pragmatic energy strategy – something that is lacking in

Scotland today. This paper sets one important step we must now take to ensure the benefits of the

next thirty years of North Sea oil and gas are felt here in Scotland and contribute fully to a growing,

more competitive Scottish economy. Described in the Conservative Commissioned Classified Mc Crones Report.

Oil Revenue from discovered oil that is left

Calculation £1200,000,000,000 (1.2 trillion) divided by Scotland's current population of 5,117,000 = £234,512 per each or average annual loss over 30 years = £7817 each per year. Westminster currently spends £8,623 per head on public services in Scotland. These figures are for oil and gas revenue only they do not include council tax, income tax, VAT, Corporation tax or the substantial revenues Scotland's makes from Tobacco, Alcohol, Whisky Production, Tourism or Renewable Energy etc. read more about the current 4.4 Billion surplus

Current Oil Revenue per annum

Calculation £1,000,000,000 (1 billion) per month divided by Scotland's current population of 5,117,000 = £195 each per day an average annual loss over £2345 each per year. See the 2006 "official" figures ?

Oil Revenue that has already been used

Calculation £250,000,000,000 (250 billion) divided by Scotland's current population of 5,117,000 = £48,856 per each or average annual loss over 30 years = £1628 each per year.

Scotland without oil revenues - i.e. as it is now, whilst part of the UK Union

The most recent Government Expenditure and Revenue Scotland (GERS) figures - without oil and gas revenues demonstrate that Scottish public finances ran current budget surpluses in each of the three years to 2007- 08, totaling £2.3 Billion. In comparison the UK ran a budget deficit in each of those years totaling -£24 Billion.

| Balance on current budget - £ billions |

2005-06 |

2006-07 |

2007-08 |

Totals |

|---|---|---|---|---|

| Scotland | £1 |

£1.1 |

£0.2 |

£2.3 |

| UK | -£13.9 |

-£5 |

-£5.1 |

-£24 |

![]() Scotland like Norway could have built up a £259 billion sovereign wealth fund retained its manufacturing base and avoided Scotland's £62.5 billion share of the London Government UK's debt of £175 billion.

Scotland like Norway could have built up a £259 billion sovereign wealth fund retained its manufacturing base and avoided Scotland's £62.5 billion share of the London Government UK's debt of £175 billion.

If we make right choices, and follow the successful example set by Norway, even investing just a part of

our oil wealth Scotland could have an Oil Fund worth almost £90 billion in just 10 years. That is £20,000

banked for every man, woman and child in our country.

If we make right choices, and follow the successful example set by Norway, even investing just a part of

our oil wealth Scotland could have an Oil Fund worth almost £90 billion in just 10 years. That is £20,000

banked for every man, woman and child in our country.

Oil and gas - along with a set of pro-Scottish business policies – have the potential to transform

Scottish prospects over the next 30 years. They are far too important to be left to London.

It is time to move on so Scotland’s precious natural resources can help fuel our nation’s future

prosperity. This would also be better for the world, as a Scottish Government would not have the same need to extract oil at the same alarming rate that Westminster is. Current oil production has never been higher.

The Facts and Figure behind Scottish Oil

An asset for Scotland’s future

North Sea oil and gas represents a huge asset for Scotland. Taking UK government estimates for oil

price and potential reserves, the total current value of North Sea oil is £1.2 trillion.

This is equivalent to total government spending in Scotland for 22 years.

It is an asset worth £234,000 for every man, woman and child in our country.

Aberdeen tycoon says North Sea oil reserves worth extra £787 billion 09/09/2009

AN ABERDEEN oil tycoon has forecast the UK’s North Sea oil and gas reserves could be worth an extra £787 billion. Read more:

What Scotland has lost?

If Scotland had invested our share of North Sea Oil revenues between 1997 and 2004 in an Oil Fund, and

if we assume a similar rate of return to Norway, then Scotland:

• We would have made a real rate return of £1.23 billion per year or £9.87 billion in total.

• We would have made a nominal rate (including inflation) of return of £1.72 billion per year or £13.78 billion in total.

WE MUST ACT NOW

Record Oil Revenues are costing every person in Scotland £2345 each a year

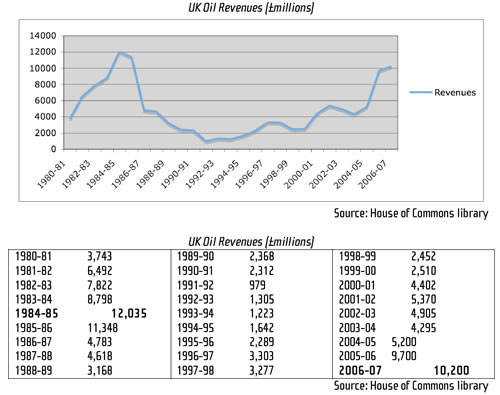

In his most recent financial report18 Gordon Brown forecast twenty-year record high oil revenues for

next year and according to the Chancellor, over the six years up to 2010-11 we will see £74 billion in oil

and gas revenues – equivalent to £14,000 for each person in Scotland. This past year revenues are

forecast to be £9.7 billion, while in the coming year they will reach at least £10.2 billion (but as much as £12 billion on current world oil prices), beaten only by the revenues received in 1984-86 – as shown

above:

GGBR in Scotland

Do the Scots and their oil subsidies the English?

The Great Deception of the Scottish People .

Read this in depth report that examines the lies that are fabricated by Westminster on the UK / Scottish Economy. (the diagram of statistics is at bottom of page) The Great Deception - GERS 2005

At present, all revenues raised from getting North Sea oil and gas ashore, and what added in Fuel Duty to Scottish Motorists is about £1bn a month. This currently goes directly to the UK Treasury. Read more

Commit to distributing these leaflets in your town and we will send you them

click leaflet for bigger image

Click here to send an e-mail